Apple Card launch: What did competitors miss?

Did you feel the earth shake on August 20th? Credit card companies sure did. That was the official launch date of the new Apple Card, a disruptive new challenger in the hyper-competitive credit card marketplace.

Textbook disruption

Apple’s strategy rocked the landscape. Within a day of launch, despite no history in the credit card business, Apple.com became a top competitor in credit card searches based on clickshare (following an increase of 10-13%). Apple Card also shot to the #3 position for impression share, appearing on approximately 70% of impressions. That means for any search of the 11 generic terms Adthena analyzed, Apple.com appeared 70% of the time and took about 10-15% of resulting clicks.

Image: Apple entering the market on August 20

In a nutshell, Apple Card soared past most rivals and dipped deeply into clicks and impressions of top credit card issuers.

Selling the un-bank

Apple has positioned the Apple Card as an antidote to the bank card, highlighting in particular its consumer-friendly features, rates, and cash-back policies. Our analysis showed that from device choices to keywords (focusing on terms like “security and privacy,” “not a bank” and “daily cash”), everything about its search strategy helped to support this USP.

Four counterpunches: What CMOs could have done (if they’d been using AI)

1. Mute the message.

Apple’s ad copy stayed religiously on-message throughout the launch. Rivals using AI to monitor ad copy and frequency would have immediately identified the common threads and been able to counter the “not a bank” storyline either with strategic copy or with strong new offers of low rates or cash-back bonuses to stop the heamorrhaging.

2. Defend branded terms.

Apple made good use of brand bidding strategies, with a whopping 12% of their impressions since the launch coming from competitors’ brand terms. Overall, Apple.com has bid on 404 terms with an estimated 655K impressions. Brand owners had no visibility into Apple’s activities or what was driving up costs for their branded terms. Brand Protection technology would have immediately surfaced this poaching behavior, enabling owners to aggressively protect their terms and take action.

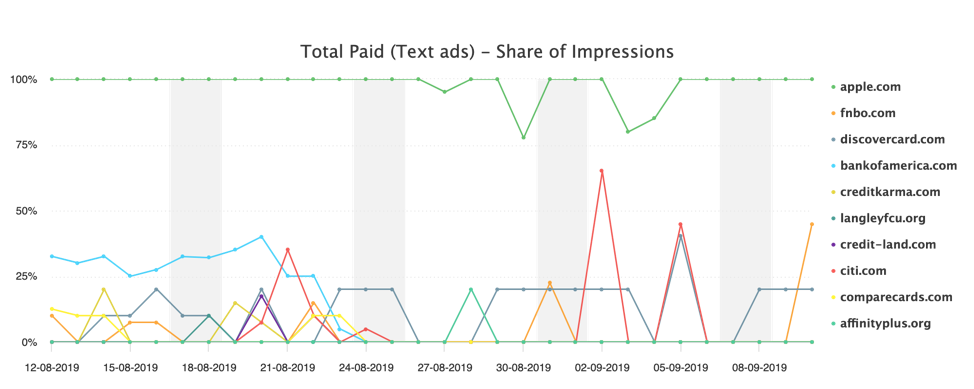

3. Bite back on Apple terms.

Apple scooped up impressions by bidding on rival brand terms while simultaneously protecting their own. Apple happily won 100% of impressions on the terms ‘apple card’ and ‘apple credit card’ across both desktop and mobile. Even a basic competitive analysis would have revealed this. While citi.com attempted some pushback, other competitors missed the opportunity.

Image: Competitors left Apple largely unchallenged on two key brand terms

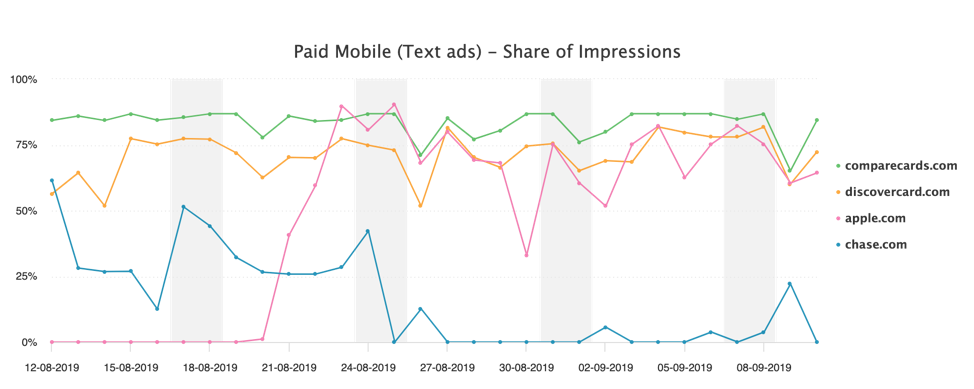

4. Dominate desktop.

Apple Card’s search strategy was 100% mobile for generic terms, with no paid search presence on desktop platforms except for a small number of key Apple branded terms. While taking on Apple on mobile would have been a costly proposition, the desktop search market was wide open. This presented a good opportunity for competitors to double-down on desktop ads and make headway across generic and branded terms.

We used Adthena Whole Market View technology to benchmark and track key aspects of the launch, how it impacted the search landscape, and how competitors responded. Our results provide a revealing window into Apple’s search strategy and some missed opportunities rivals may be regretting.

Using our data, we analyzed 4.5M monthly impressions across 11 search terms to see Apple Card’s impact in paid search. We also looked at Apple’s activity on branded terms, both its own and those of rivals.

A lesson for every CMO

Hindsight is 20/20. But no search marketer should rely on hindsight to make decisions, especially in the highly competitive financial ecosystem. To learn more about using AI-driven technology to compete in the credit card sector, download our CMO Search Intelligence Brief for the Credit Card Industry.

Adthena’s AI-driven Whole Market View technology and solution service packages provide the before-during-and-after search intelligence and insight search marketers need to predict, monitor, analyze, and respond strategically to new market threats, new challengers, and changes in competitor activity.