Credit Cards go head-to-head: defensive and offensive SEM recommendations

In our new CMO Search Intelligence Brief for the Credit Card Industry, we’ve pitted the top 120 credit card companies in the US against one another to see who’s performing best in paid search in this fiercely competitive market.

Using our AI-powered, Whole Market View, we’ve evaluated the finance search market and created the Search Intelligence Index for credit cards, comparing each company’s search behavior against other top-performing players. Each company’s overall score is averaged on a scale of 0-100 by analyzing search performance across three categories: Market Leadership, Search Excellence and Brand Ownership, with the market average set at 50.

To see the full index and leaderboards, download the report on our credit card search intelligence hub page and even request your own individual score.

In this article, we take a deeper look at four competitive credit card matchups between an industry leader and challenger to reveal insights and recommendations to drive growth and digital transformation and improve the customer journey.

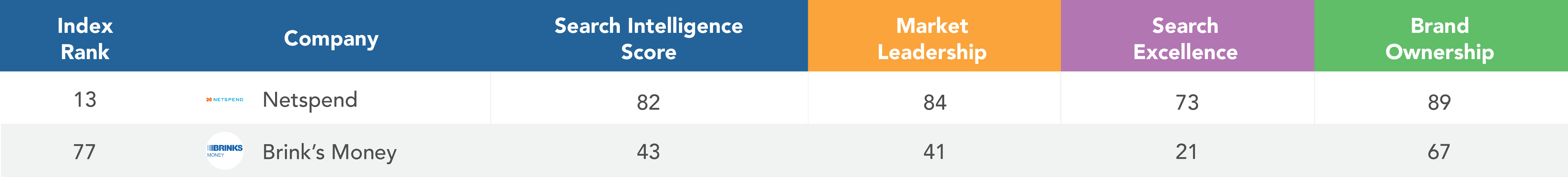

Major Credit Cards – American Express vs. Wells Fargo

On Defense – American Express

With a Search Intelligence Score of 92, American Express dominated the credit card search market. To maintain its leadership position, the company should focus its efforts on improving Search Excellence (83) as other companies will continue to raise the bar and evolve their search strategies.

Action: Ensure messages and offers are aligned with consumer wants and needs, especially with new threats like Apple Card entering the market. Analyze performance by category and region to keep SEM budgets focused on areas of highest return, further optimizing return on ad spend (ROAS).

On Offense – Wells Fargo

Despite being one of the largest credit card issuers in the U.S., Wells Fargo’s SEM performance is in the middle of the pack. The bank could make the strongest impact on its SEM position by boosting Market Leadership (49) and Search Excellence (36). These scores show that the company spent more than competitors to reach the same results. Wells Fargo will not only need to extend its reach to cover a wider segment of the market, but can also take action to increase its SEM return on investment (ROI).

Action: Conduct an SEM opportunity analysis to set a focused SEM strategy, allocating budget to areas of high performance and lower competition to spend more effectively and identifying the best messaging, positioning, and offer to win in each area.

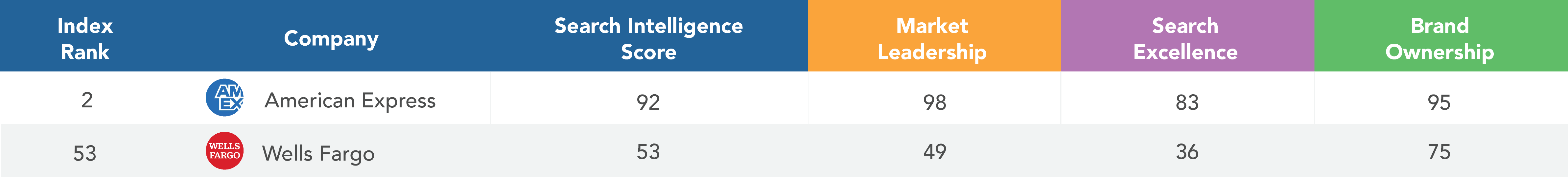

Prepaid Cards – Netspend vs. Brink’s Money

On Defense – Netspend

Netspend landed just outside of the top 10 window with a Search Intelligence Score of 82, but is leading amongst purely prepaid card providers. With a Brand Ownership score of 89, the company has strong control over its brand name in search, but needs to hone its Search Excellence if it wants to stay at the top of this market.

Action: Netspend is one of the more effective market leaders on optimizing their spend, indicating they are allocating their budgets effectively. However, their ads do not drive nearly as many clicks as others in the industry. By optimizing their customers’ search journey with clear and valuable calls to action, Netspend’s prospects will be able to research and buy products more easily.

On Offense – Brink’s Money

Brink’s, perhaps best known for its money-transporting armored trucks, entered the consumer payments market in 2015 with the launch of the Brink’s Prepaid Mastercard in partnership with Netspend. Now, the two companies are going head to head in search.

With a below-average SEM performance in the credit card search market, Brink’s has a significant opportunity to improve its search channel for its credit cards. The company’s success was hindered by competing on expensive terms where their message didn’t resonate and limited search term coverage in the credit card search landscape. This means that not only did Brink’s pay more than its peers for each click it received, but it also may have pigeon-holed itself into a small portion of the credit card market.

Action: Run a detailed analysis of the SEM landscape to fine tune ad copy messaging in the categories and search terms where Brink is competing effectively, shift budget away from areas where they are not, and expand into areas that show promise due to low competition and consumer intent well aligned with Brink’s value proposition.

Department Stores – Macy’s vs. JCPenney

On Defense – Macy’s

Macy’s emerged as the leading department store in the credit card search market, with popular store credit cards like Nordstrom and Kohl’s absent from the landscape altogether. Macy’s high Search Excellence score (93) indicates that the store used search effectively to garner consumer engagement. However, it can get more value out of its SEM by focusing on Market Leadership (56) to extend the reach of its ads and Brand Ownership (87) to strengthen brand visibility and avoid being overshadowed by competitors.

Action: It’s common practice for companies to steal search traffic by bidding on their competitors’ brand names. Implement strong brand monitoring to prevent any negative impact from competitors and control the brand experience for prospective customers. Additionally, grow ad exposure by identifying new audiences or market segments to target.

On Offense – JCPenney

While JCPenney was in the top half of the search market for credit cards, a low Market Leadership score (19) hindered its SEM success. The department store had a narrower reach and lower conversion in search than its peers. It’s likely that JCPenney is targeting a comparatively small segment of its market or not effectively reaching or engaging its audience.

Action: Identify new market opportunities and expand target audience segments to better rival peers like Macy’s. Considering the fierce competition in the credit card market, also consider increasing SEM budget to maximize conversions.

Airlines – Delta vs. Alaska

On Defense – Delta

Delta is the second-largest U.S. air carrier by passenger count, only behind Southwest (ranked No. 41 in the index). But the company is leading the credit card search market amongst airlines. Delta performed best in Brand Ownership (86), indicating that it created opportunities to gain brand exposure and capitalize on brand search terms. When consumers searched for the Delta brand, they usually found it at the top of the page.

Action: Implement more relevant and personalized offers and messages to different audiences to increase ad engagement. Gain a deeper understanding of online customer behavior to ensure prospects are able to find and engage with the company when and how they want to.

On Offense – Alaska Air

Alaska Air is the seventh-largest U.S. air carrier by passenger count, but was only out-performed in credit card search by Delta, Southwest, and United.

Boosting Market Leadership (28) should be Alaska’s most immediate priority in its SEM strategy for its credit cards. The airline’s ads didn’t appear on a wide range of search terms, reducing its market share potential, and were also not seen by a large number of consumers.

Action: Redistribute SEM budget to focus on areas of lower competition to have a better chance of dominating less competitive market segments. Identify areas to expand to where consumer search intent aligns well with Alaska’s credit card value proposition and enter these areas with compelling offers and messaging.

To see the full CMO Search Intelligence Credit Card index and leaderboards, request your own individual score, or discover additional content relevant to the credit card space, visit our Credit Card Hub page.