A new generation of UK fintechs such as Monzo, Revolut and Monese is clearly shaking up the banking industry. With 77% of UK residents considering using only digital banks and only 21% planning to visit an actual bank branch in the next few months, challenger banks are here to stay. But what has the impact been on the search landscape? And what does the future look like for high street banks online?

To find out, we took a deep dive into our CMO Search Intelligence Index for the UK Finance Industry. We assessed the data for the UK banking sector to see how banks with physical branches are performing against their digital-only counterparts in paid search.

The results are telling. While established banks currently hold the top spots in terms of overall search performance, they’ve definitely left the door open to challengers like Starling Bank, which ranks #5 among UK banks on our index and whose all-out offline marketing campaigns may fuel even higher search performance in 2020. Here’s a look at how banks can bolster their index scores to improve search performance and ROI.

About the index

Our CMO Search Intelligence Index offers financial companies in the UK an objective measure of search marketing success. It reveals how leading players and up-and-coming challengers are performing in search marketing, giving marketing leaders a benchmark for their own success. Each company in the index receives a Search Intelligence Score (of 0-100) calculated using a methodology that evaluates leadership, performance and brand strength in search, with the market average score set at 50. The score considers factors such as a company’s search effectiveness, search spend optimization, and market share.

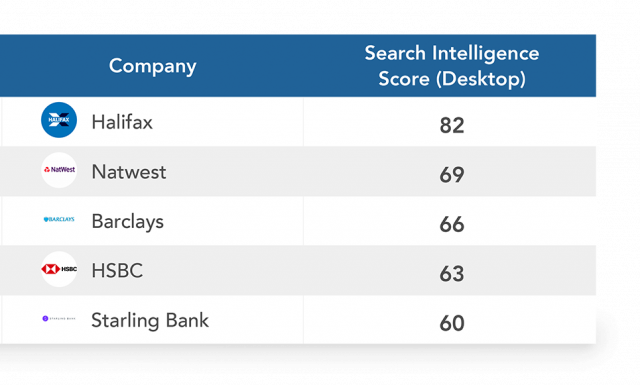

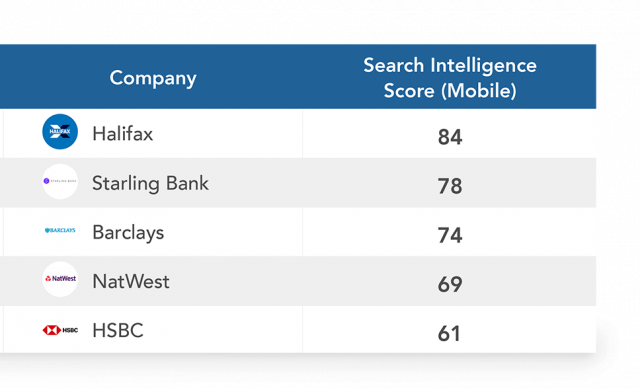

From our index of 150 financial players in the UK, here are the top five banks for both desktop and mobile search.

Search Intelligence Scores – Top 5 Banks (Desktop & Mobile)

High street dominates, but it’s not bulletproof

With four out of five of the best performers representing established highstreet banking brands, it’s clear the challenger banks have some work to do. But much of this dominance is to do with breadth of service offerings (Natwest, for example, plays in many more search categories than a newer entrant like Starling), and efficiencies that have developed over time. High-Street banks, who are already established in the market, will overall have lower go-to-market costs due to time already spent optimizing and achieving optimal search journeys, in turn reducing their costs to secure the click. Challenger banks will face an uphill battle and must invest heavily to achieve market penetration, which will impact their spend efficiency.

However, the desktop gap for Starling is far from insurmountable, and in mobile, they rank #2 among UK banks on the list. With search intelligence scores down in the sixties (with 50 representing the industry average), banks like Barclays and HSBC have plenty of room for improvement when it comes to their own search performance.

And of course, brand reputation goes a long way in the search realm, one reason Starling Bank is the only challenger bank to appear in the top 150 on desktop.

Betting on brand

It’s not surprising that Starling’s search performance is relatively high on mobile, where its digital-native audience resides and most of its sign-ups and transactions take place. Mobile search is always going to be a marketing priority for newer banks. On the other hand, with reduced screen space on mobile, the risk of falling below the fold grows. This means brands are left at the mercy of a user’s willingness to scroll down, and allows those at the absolute top to secure clicks. With Google’s sunsetting of average position, this risk has only increased.

So what about all that offline advertising?

You’ll see ads for Starling all over TV and public transport, where they are clearly spending significantly to establish the brand as a virtual IP. That saturation will feed right into the bank’s search strategy. By heavily promoting and establishing mindshare for its brand offline, the bank can count on a high percentage of search traffic coming directly from searches for “Starling” or other branded terms featured in its marketing. As a result, they can spend less on expensive generic search terms, recoup their offline marketing investment, and raise their index scores based on efficiency and brand ownership.

What’s more, offline marketing is a way for challenger banks like Starling to use advertising psychology to build trust for their brand. The more consumers that see the brand on TV and out-of-home media, the more credible the brand becomes as a “real” bank, not just an online upstart.

Heads-up on the high street

As agile startup banks like Starling continue to build brand awareness and name recognition, high-street banks will need to have a counter-strategy prepared to protect their search positions and market share. Already, Starling has the second highest Search Excellence rating, a component of the search intelligence score that measures search efficiency, indicating that conventional banks are spending more and getting less, when looking at the targeted by each.

For now, the UK’s high-street banks have a hold on the Search Engine Results Pages (SERPs), at least on desktop and when it comes to generic banking terms. But that can change in a heartbeat. Now is the time for banks to take a hard look at their own search score: start monitoring the competitive landscape by device for new challengers and strategies; optimize offers and ad copy to maximize performance; and be ready to respond quickly and decisively when trends emerge in the market.

To get the big picture in UK finance competitive search, download the full CMO Search Intelligence Index now and see further insights on our UK Finance hub page.