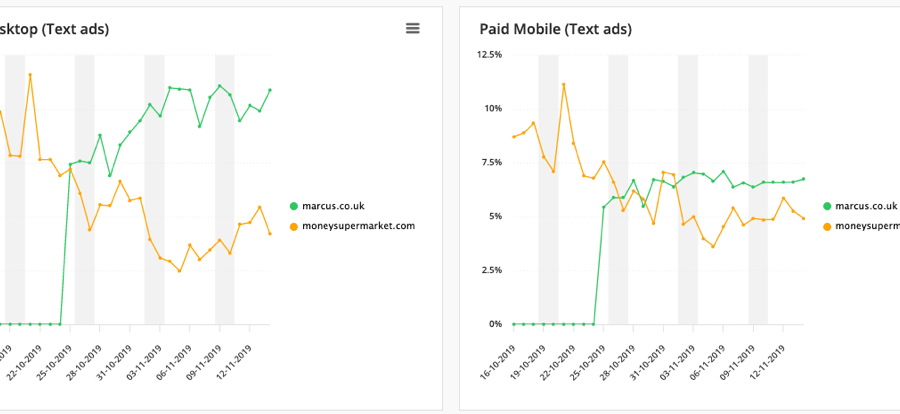

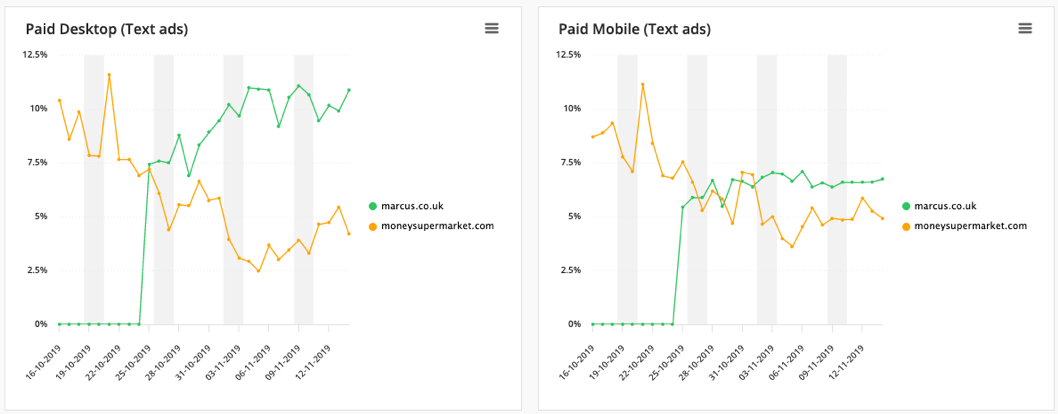

On October 24, Marcus by Goldman Sachs entered the paid search bank accounts category in the UK with an aggressive strategy that caught some competitors napping. The day before the Marcus move MoneySuperMarket held 12% market share across all terms in the category for ‘bank accounts’. On the 24th, Marcus entered the landscape and forced MoneySuperMarket’s share down to 4%, sinking still further over the following 2 weeks, to 2.5%.

By mid-November, Marcus had captured 11% market share for generics.

During that time, Marcus began appearing on 3 out of the top 5 best-performing terms that MoneySuperMarket was appearing on:

1. Best savings acct

2. Savings acct

3. Best instant access savings acct

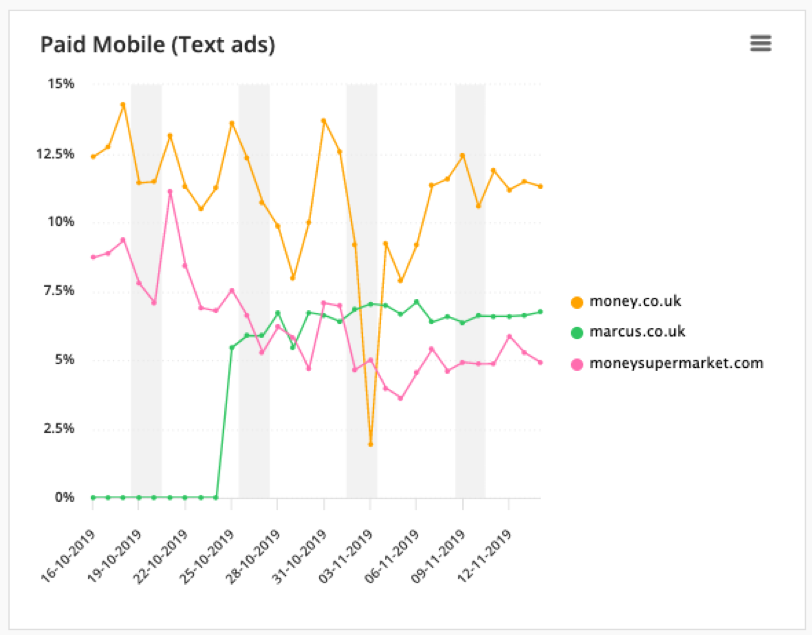

On mobile, the Marcus debut had a similar impact, with MoneySuperMarket’s share of generics falling from 12% to 5%. Another top player – money.co.uk -also took a market share blow but managed to regain its status and land at about 11%. Marcus’ share on mobile, while not as significant as on desktop, still hovered at around 7%.

The lesson?

In finance and in any market, your search strategy cannot be static. Search marketers need to proactively monitor competitor activities and be ready to respond to changes in strategy and new market entrants. With new fintech companies emerging all the time, you need to continually scan the search landscape to spot threats as they arise and be ready to parry with force.

Using the latest Search Intelligence, Marcus’ competitors could have seen the company’s aggressive search strategy in play and fought back on generic terms and even Marcus’ own branded terms on desktop and mobile, to protect their share of converting consumers. By leveraging AI-powered threat detection technologies, you can ensure you’re always one step ahead of your competitors’ strategies. And with more competitive intelligence, you’re able to react swiftly to market shifts.

With Adthena’s Strategic Advantage Solution, search marketers can predict, analyze, and exploit competitors’ plans before they take hold. Our threat detection and AI-powered technology, Smart Monitor, helps world banks stay on top of market shift. Our customers can rapidly respond to competitor movements to protect and take advantage of unique opportunities to increase search performance.

As the banking sector gets more crowded, competitive monitoring and intelligence becomes more vital in search. Request a demo with us to see how it’s done.