One of the biggest threats to your policyholder experience is insurance claims companies. They insert themselves into the claims process between the customer and the insurer to skim profits and scam consumers into believing they are necessary or beneficial.

In fact, these businesses are set up with the sole purpose of defrauding customers by convincing them to make their insurance claims through the claims company. This raises the cost of the claim to the insurer, and for the consumer, three things can happen:

- The customer has a poor customer journey that could cause them to change insurers.

- If the customer calls the claims company, they may be charged for calling a premium-rate number.

- The customer might have the company show up at their house and take their vehicle to an impound for the sole purpose of charging a release fee to complete the claim.

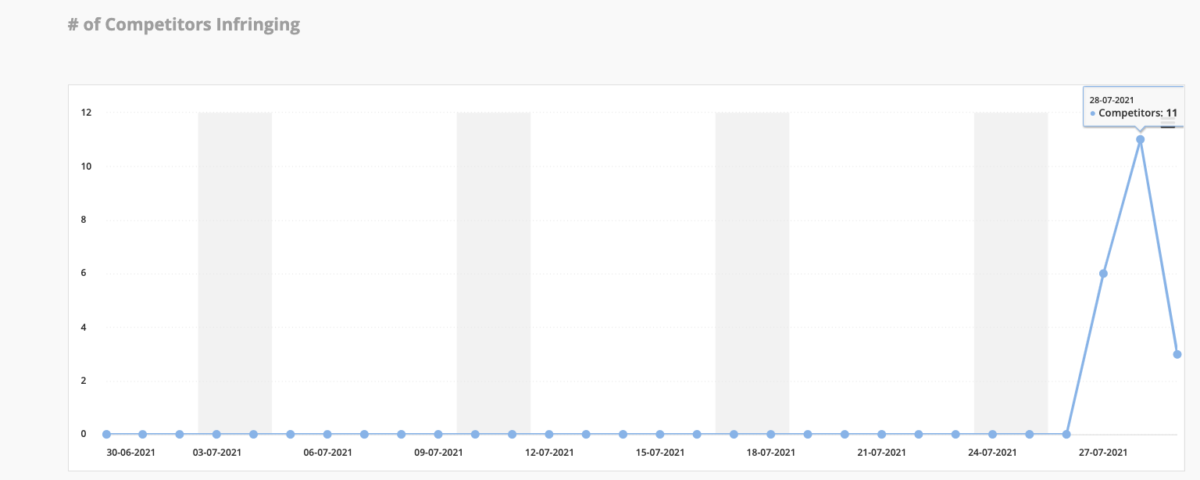

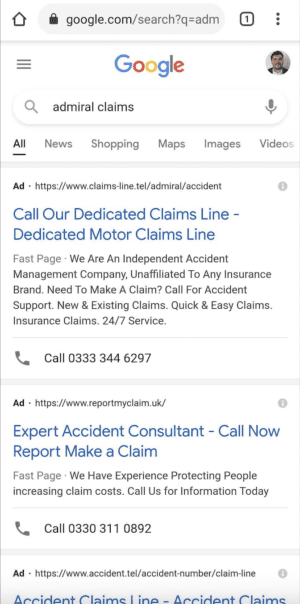

Above: The volume of scam companies targeting insurer Admiral every week equates to hundreds of customers being directed away from their website and into the hands of claims companies.

Scammers are active on Google Ads

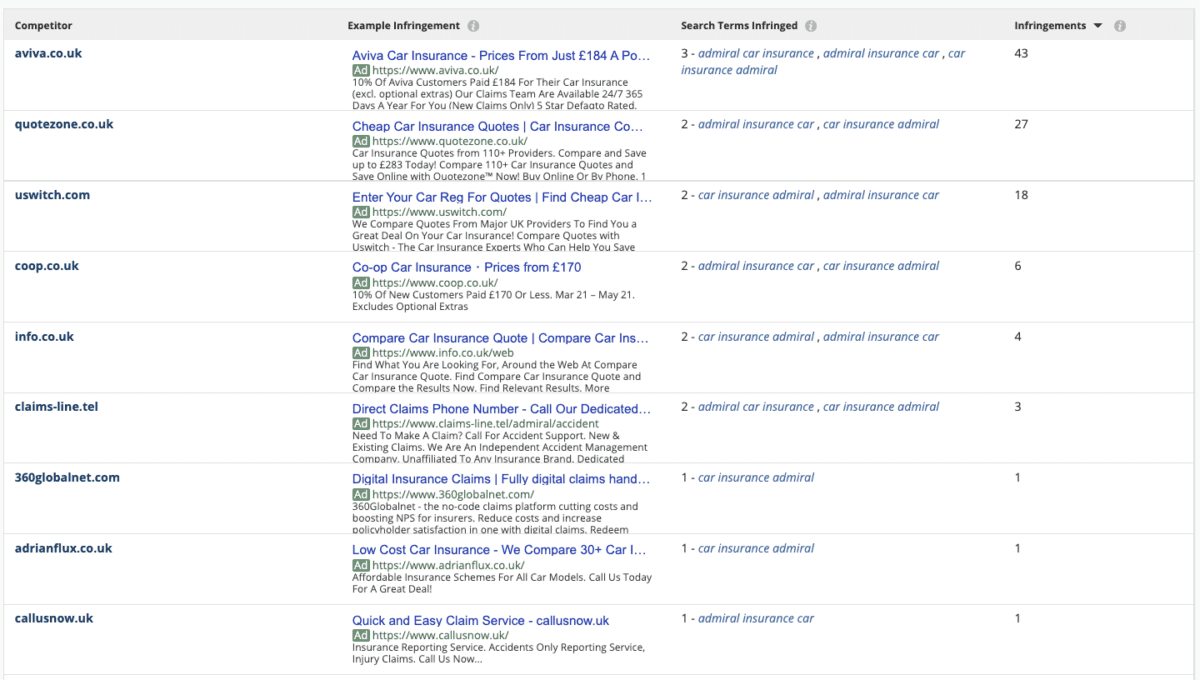

One of the main ways these claims companies poach customers is by running ads on Google — ads that may include trademarked terms to deceive the consumer into thinking the company is affiliated with the insurer. They bid on branded terms such as “Admiral Claim” and then poach clicks that should be going directly to the brand.

With ad copy designed to deceive already-stressed customers, claims companies can lure customers into a third-party mess.

A big industry problem

Adthena’s analysis reveals that this problem is surprisingly widespread. We discovered more than 40 insurers that were affected to varying degrees, and that’s likely just scratching the surface. The impact is not only on customer experience, but also on profitability, because claims cost more to settle when there is a third party involved as third parties charge large fees for vehicle releases and their administration costs.

Above: This list shows just a handful of the UK insurers that are being targeted by claims companies. The scope is not surprising, given the difficulty of manually monitoring infringements. The Adthena AI also shows the average position of the advert on the SERP and it’s estimated clicks (this is over a 7 day period in July).

How can insurers stop claims poachers on the SERP?

Manually monitoring the search landscape for brand infringements is virtually impossible. Search teams would have to search dozens of queries multiple times each day to have any impact — a labor that is simply not efficient or feasible for most marketing teams.

With an automated approach, however, brands can make huge gains against claims companies in a fast and efficient way.

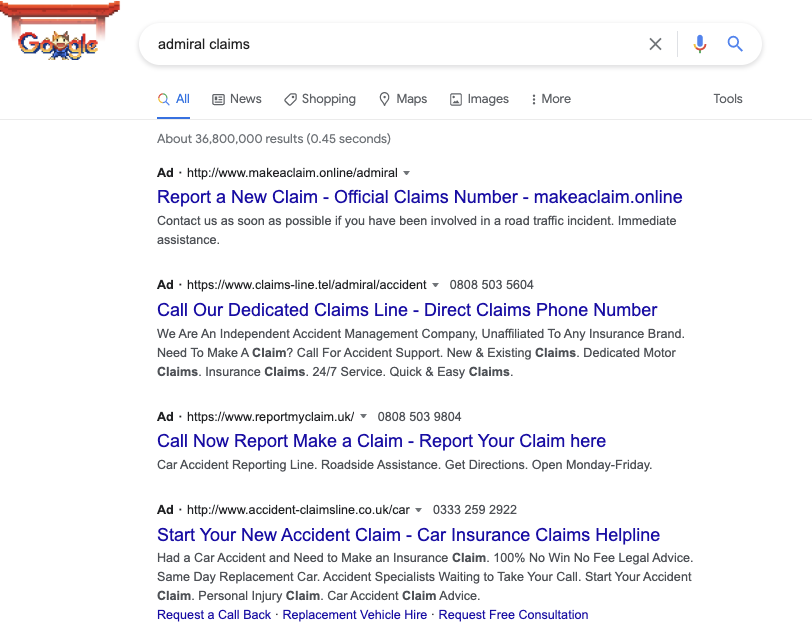

Above: These URLs are made to look like genuine insurance claims websites by imitating the companies they are targeting, in this case Admiral Insurance.

Stop the claims scammers with Adthena

Using Adthena’s search intelligence platform and Smart Monitor, you can scan your entire market for brand infringements by claims companies and proactively report alerts to your team. Smart Monitor scrapes the SERP hourly and alerts you to infringements on your trademarked terms that appear anywhere within competitors’ ad text.

You can direct reports to go to your legal team or to front-line PPC executives who can report infringements directly and immediately to Google for fast take-downs.

Adthena even makes it easy to collect proof, including time-stamped evidence and the unique URL for the SERP.

Above: To a stressed-out policyholder trying to make a claim, these search results can be incredibly confusing. It’s not surprising they are duped into clicking on bad actors’ ads.

The benefits of an automated approach to stopping claims companies can be huge. Your customers will be kept safe and protected from claims interlopers; your brand reputation and investment in customer service will be protected, and you’ll save thousands every month in client churn and inflated claims costs.

Start protecting your brand and your policyholders

For a quick demo of how you can protect your brand from claims copycats, reach out to George Hancock at Adthena any time.