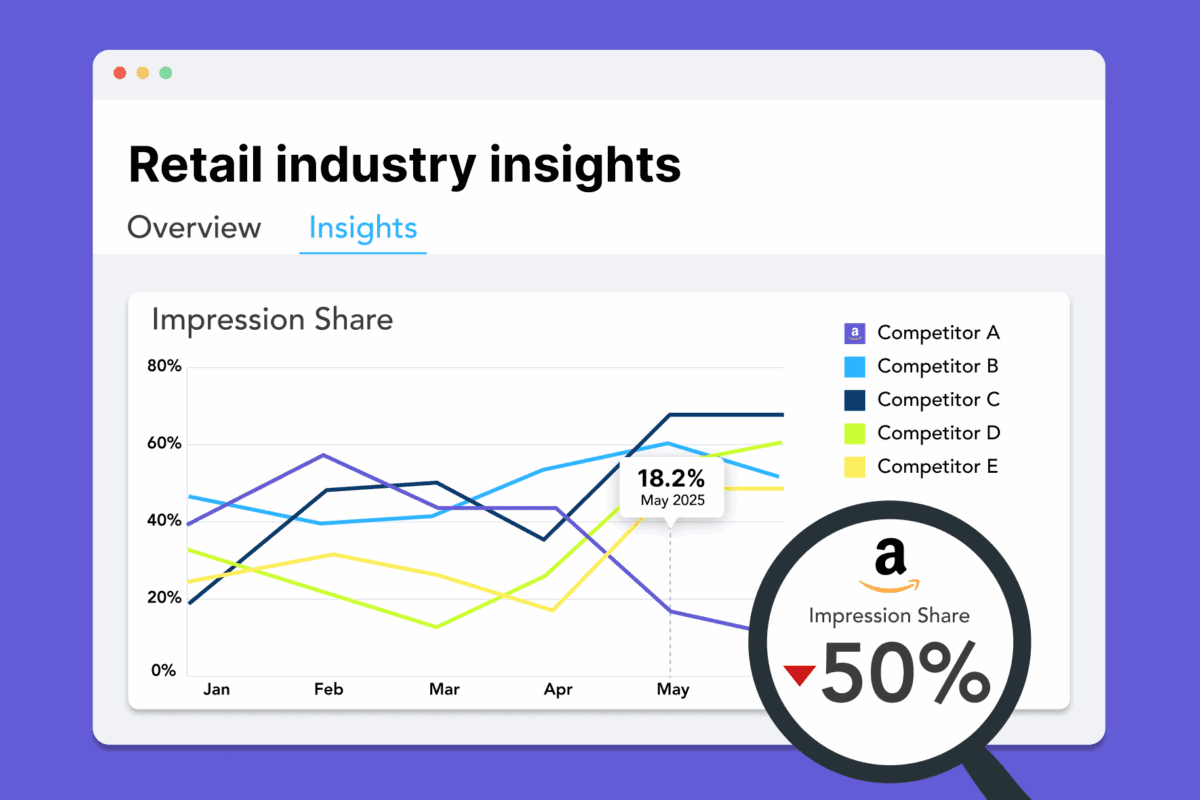

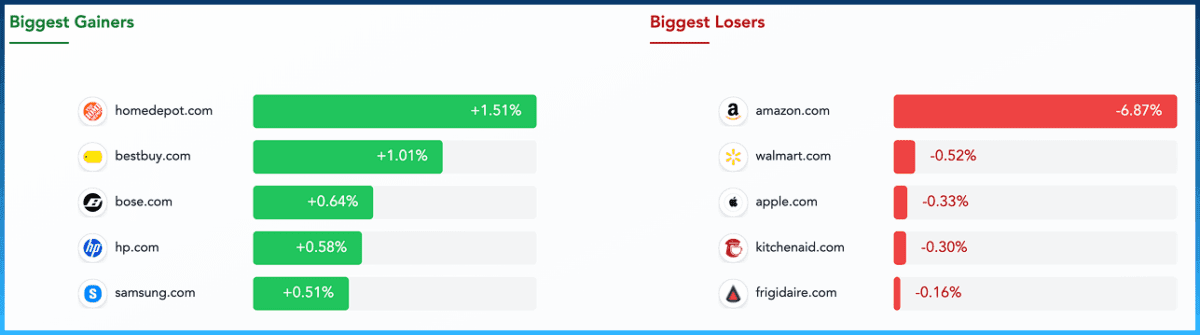

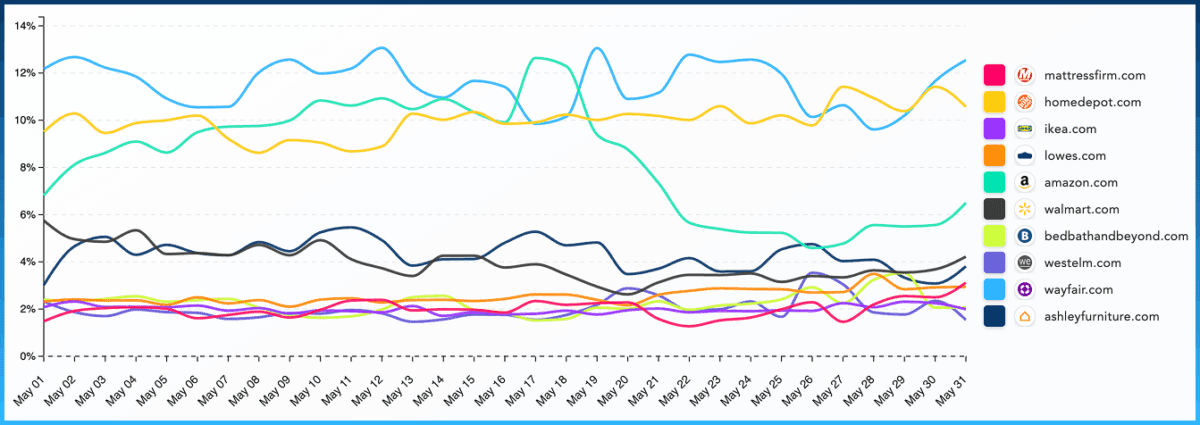

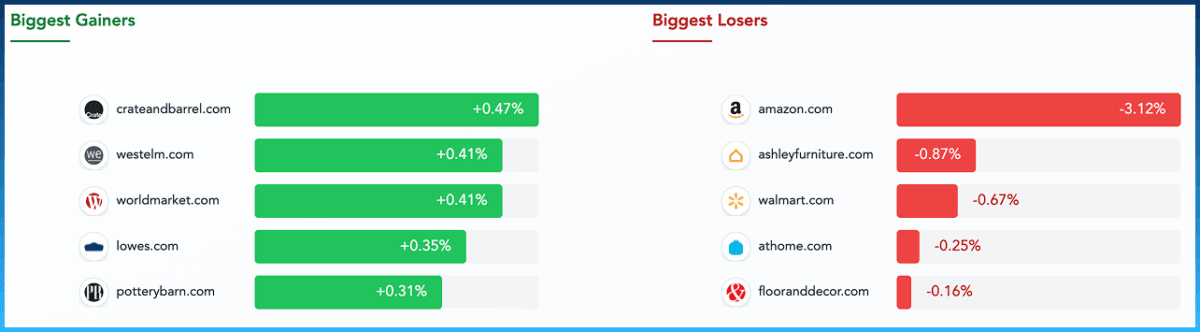

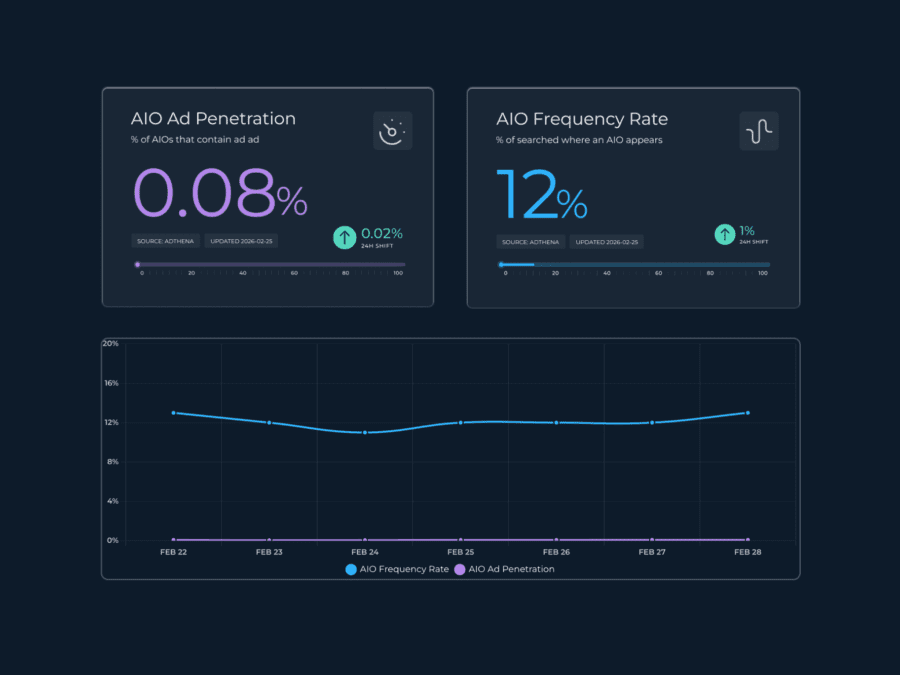

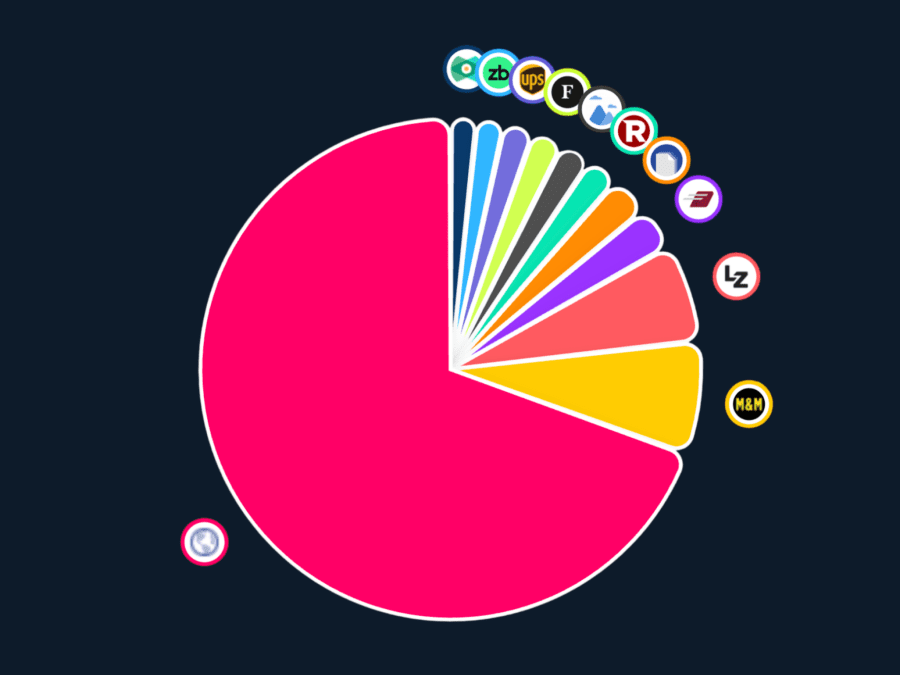

Amazon has long been the dominant force in Google Shopping auctions, often overshadowing even the biggest retailers. But according to Adthena’s search intelligence data, something major shifted in mid-May.

Using Adthena’s market-leading search intelligence, we observed Amazon’s Shopping impression share drop sharply and suddenly, and it’s remained at around half its usual level ever since. This isn’t just a short-term blip, it’s the most significant pullback we’ve seen since the 2020 pandemic pause.

As the eCommerce giant steps back, new space is opening up, creating a rare acquisition window for competing retailers ready to act.

For advertisers, this raises major questions:

- Who’s filling the gap?

- How long will this retreat last?

- What happens when dominant players step back?

In this blog, we’ll surface how the shift is playing out and what it means for competitive strategy in Shopping.

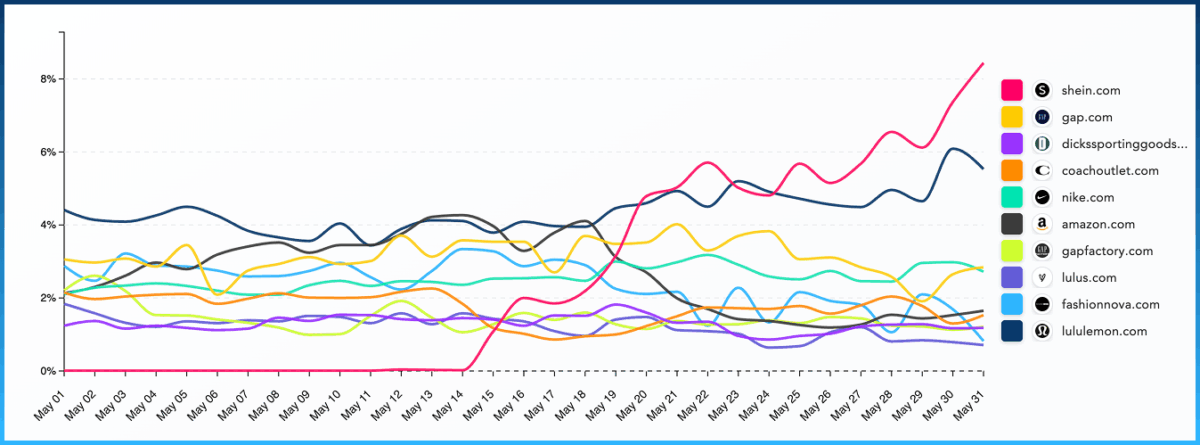

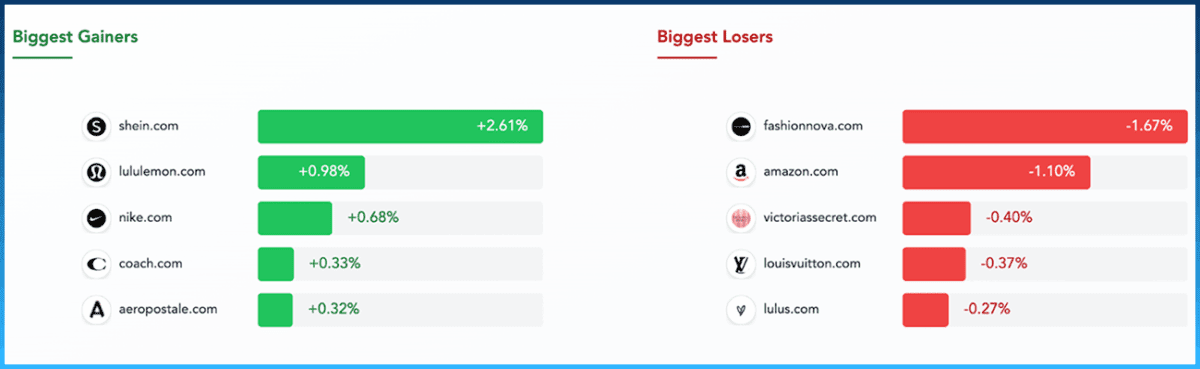

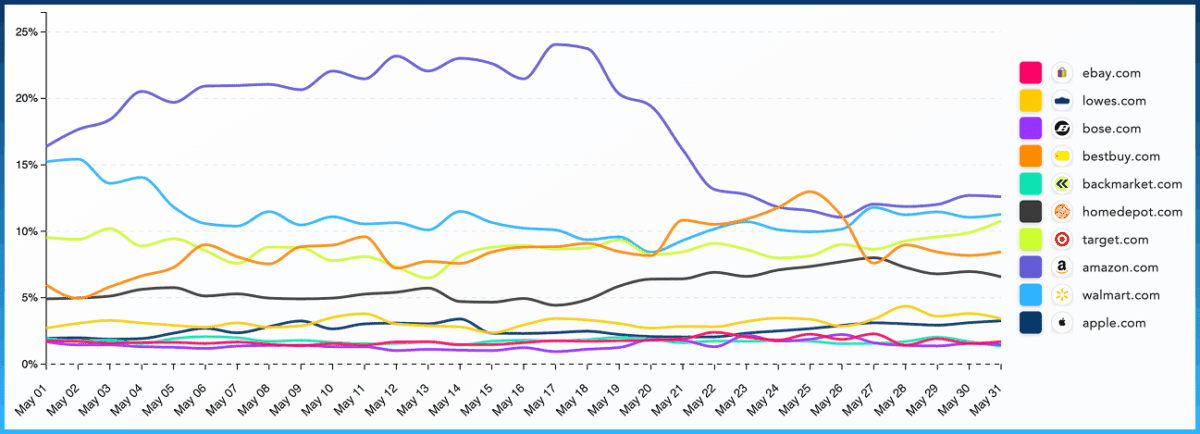

Here’s what we’re seeing across Apparel & Accessories, Electronics & Appliances, and Home & Garden.