Read article

Read article

Read article

Read article

View case study

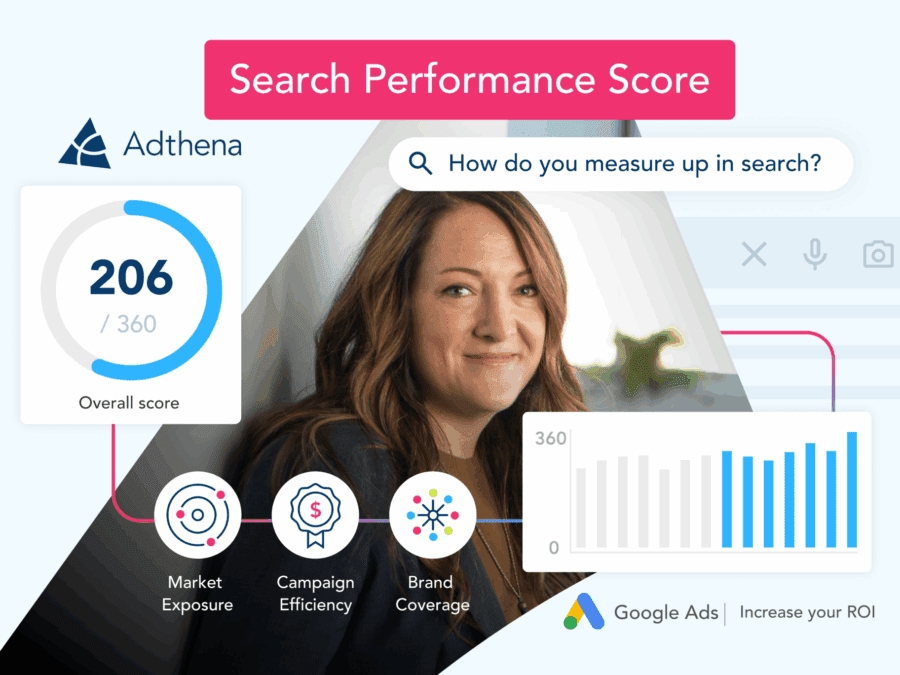

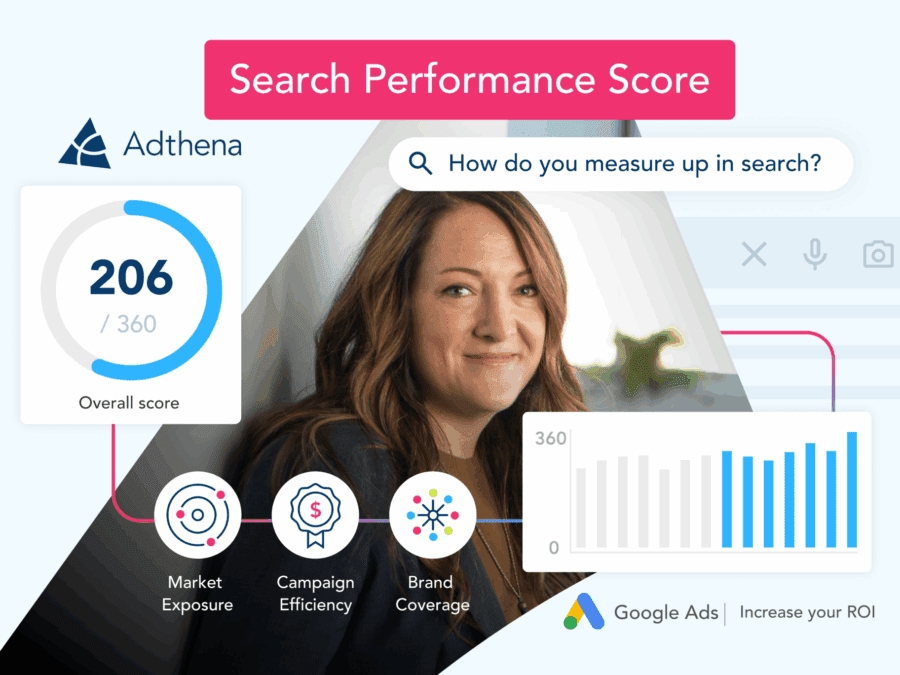

Access the latest search marketing reports, guides, webinars, and case studies at Adthena's Resource Hub. Get actionable insights to drive your PPC performance.