Restricted high stakes verticals

In this early alpha, certain “sensitive” sectors are strictly excluded. While Real Estate is permitted, categories like Finance and Health are currently ineligible to participate, ensuring the platform maintains a conservative stance on ads appearing next to regulated advice.

Targeting constraints and national scale

The current testing environment lacks granular controls. There is no geographic targeting below the national (US) level, no time of day scheduling, and notably, no daily budget caps, creating a “wild west” environment where budgets can be consumed rapidly.

Purely contextual, keyword-driven logic

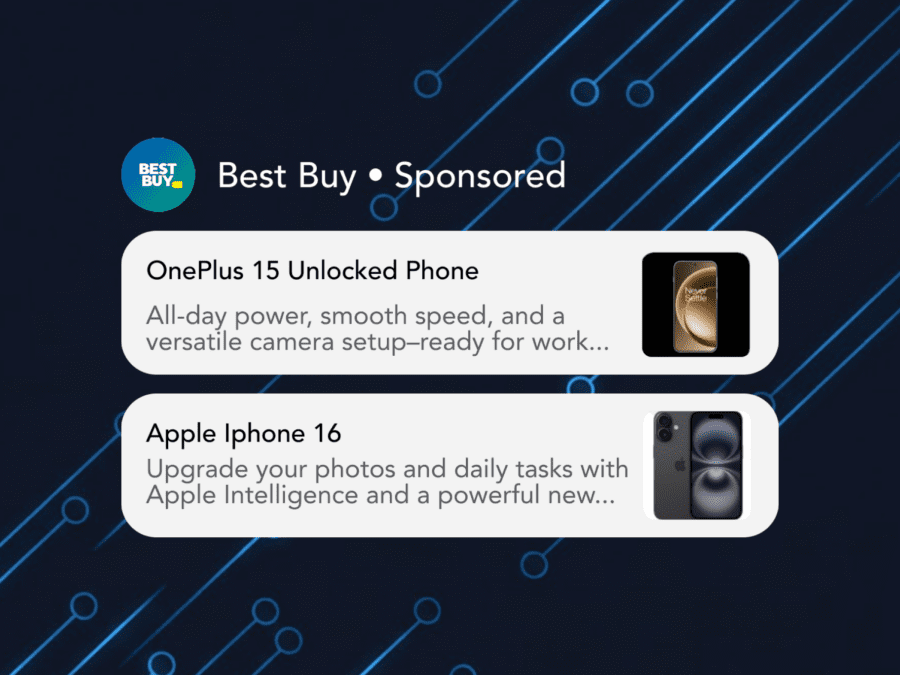

At the heart of the alpha is an exact match keyword architecture. Ads only surface if a prompt contains a specific keyword defined by the advertiser, emphasizing immediate contextual relevance over historical user behavior.

Strategic conquesting opportunities

Advertisers are actively encouraged to bid on competitor brand names. Because many users use ChatGPT to compare products or services, these “comparison prompts” represent a primary battleground for early adopters to intercept high-intent shoppers.

Limited negative keyword guardrails

While advertisers can provide unlimited positive keywords to trigger ads, the platform currently limits negative keyword lists to a small number of terms. This requires brands to be extremely surgical in identifying the most critical “off limits” contexts.

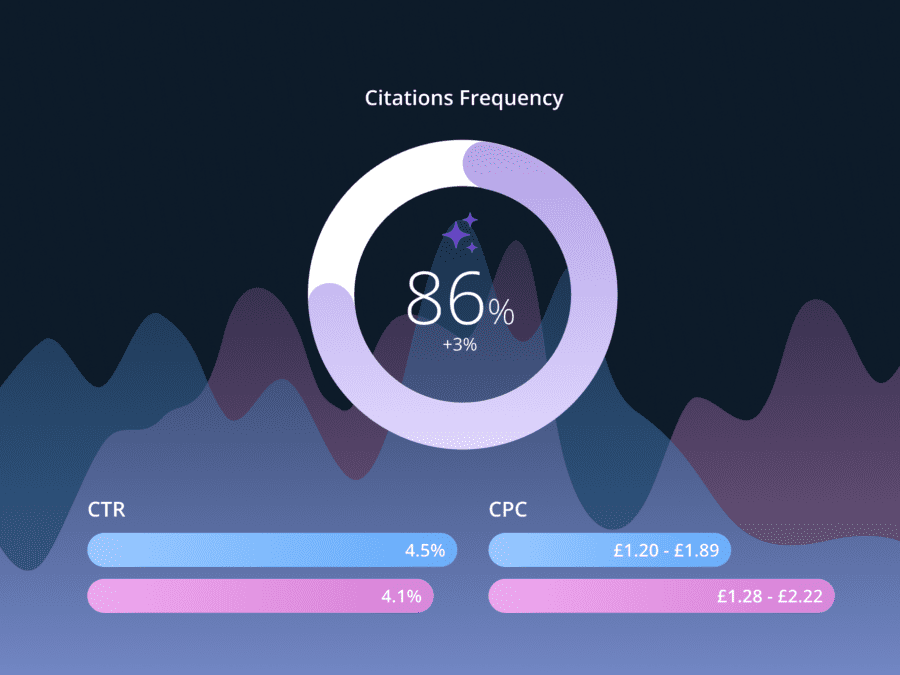

Manual reporting and lack of UI

The alpha operates without a self serve dashboard or login interface. Advertisers are managed manually and receive performance data only once a week via a basic CSV file, limited to core metrics like campaign name, impressions, and clicks.

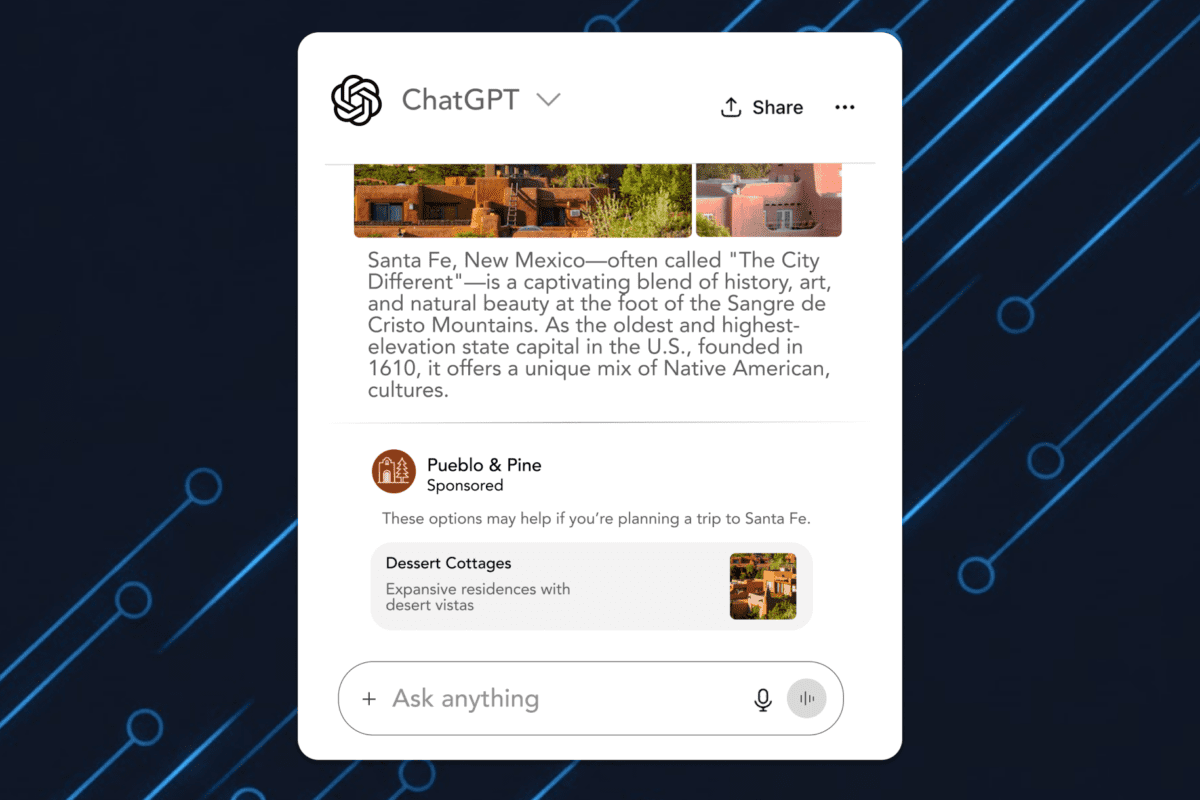

Zero impact on AI model responses

To maintain user trust, the platform has established a firm wall between advertising and intelligence; brand spend does not influence the organic AI response, and ads are clearly separated and labeled below the generated text.

Based on these early conditions, this post brings together advertiser pain points and five predictions on where clarity will be most urgently needed as brands prepare to test, learn, and compete in a fundamentally new AI-driven landscape.