As AI transforms how patients and healthcare professionals search for information, pharma brands must adapt their strategies to remain visible in an increasingly AI-mediated search landscape.

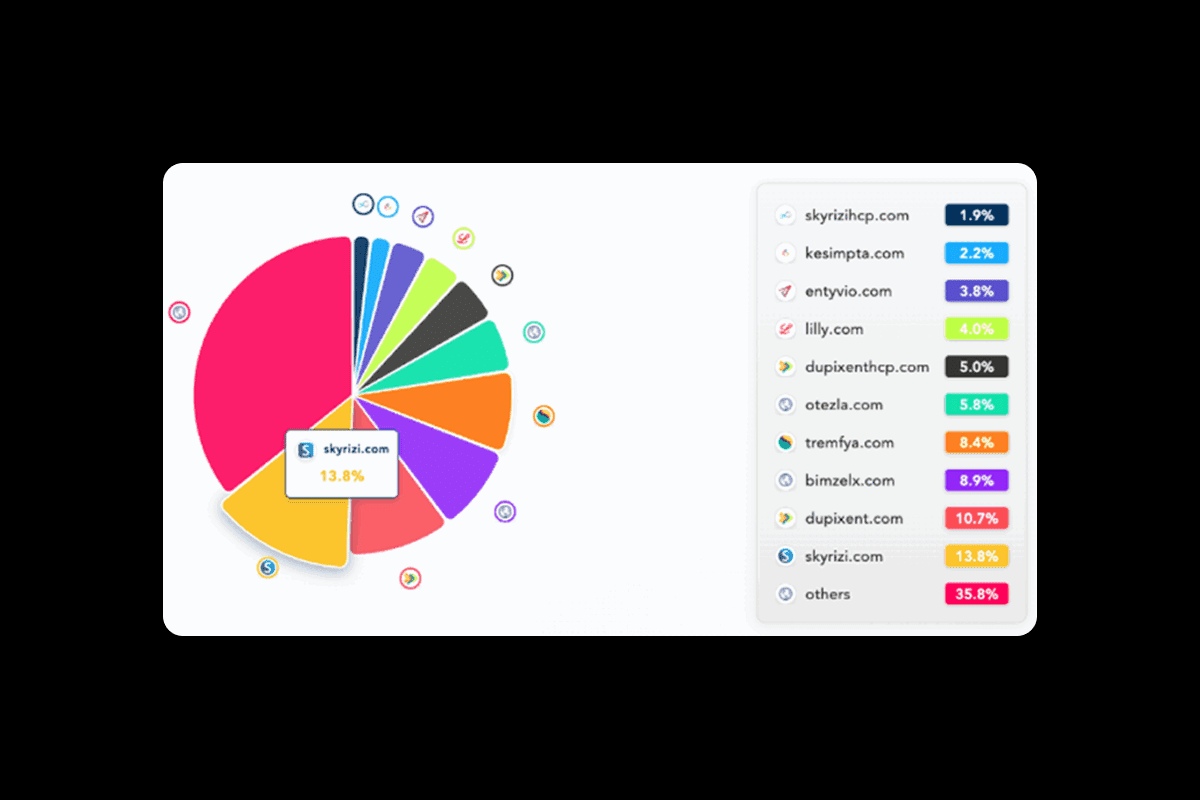

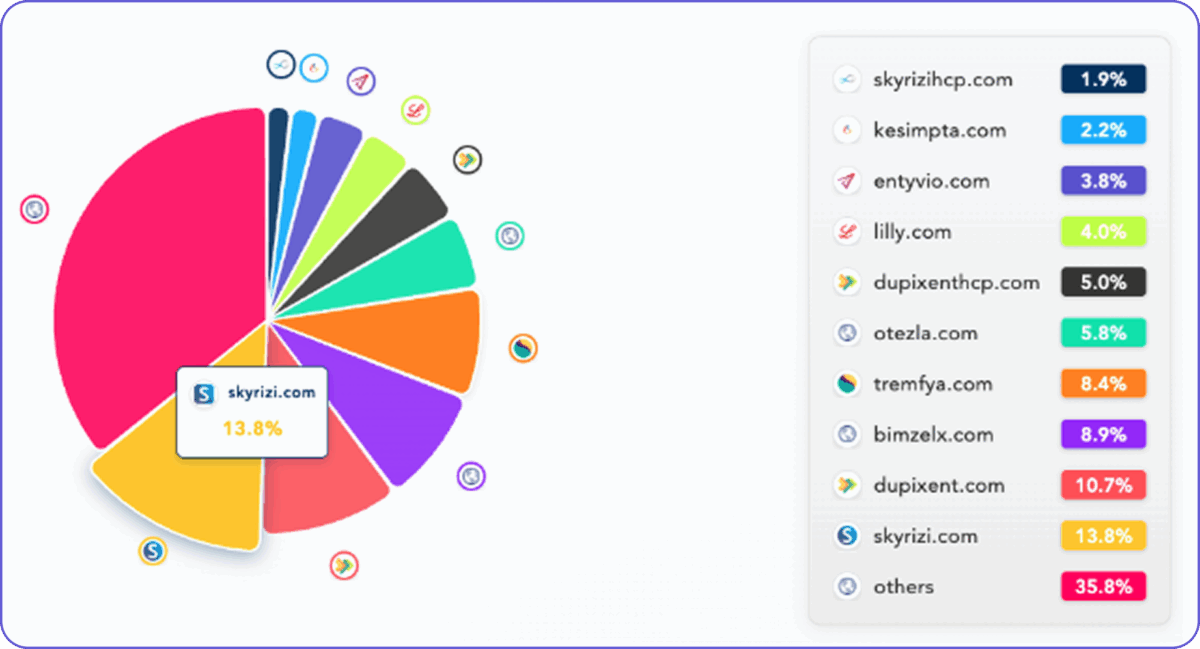

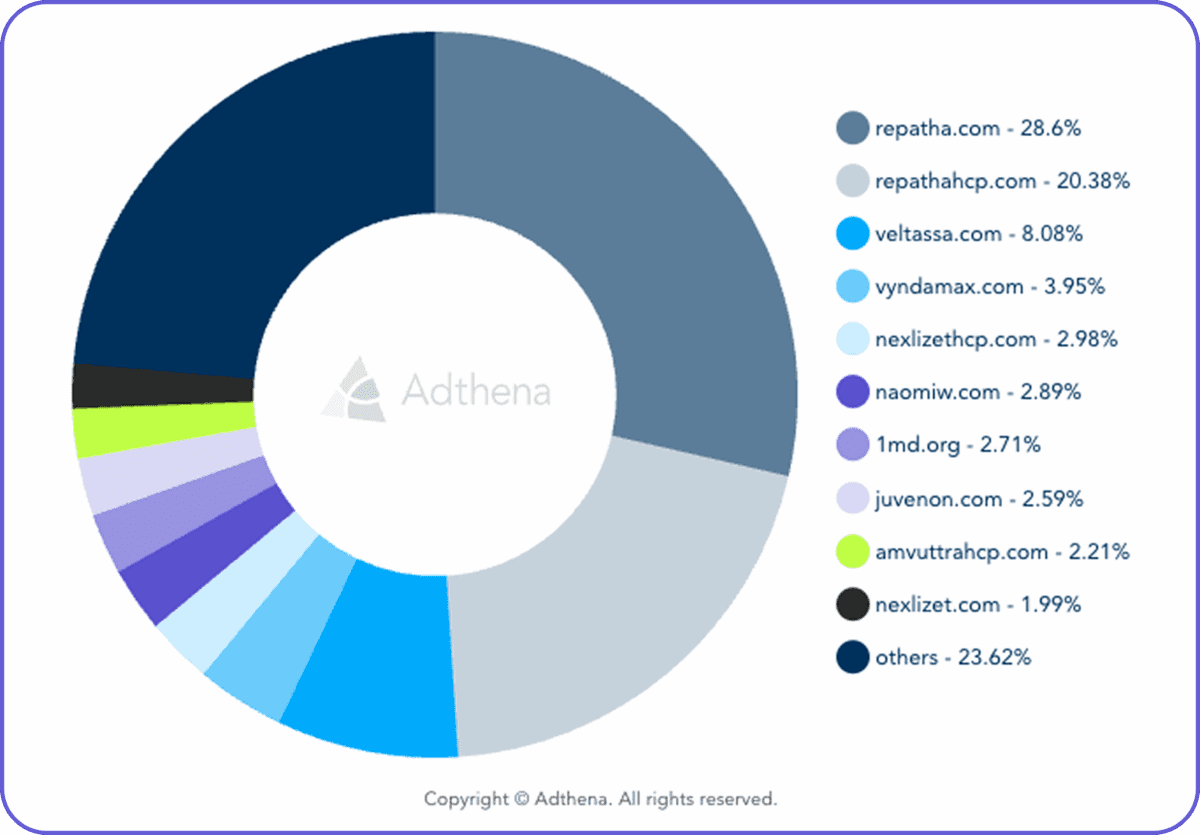

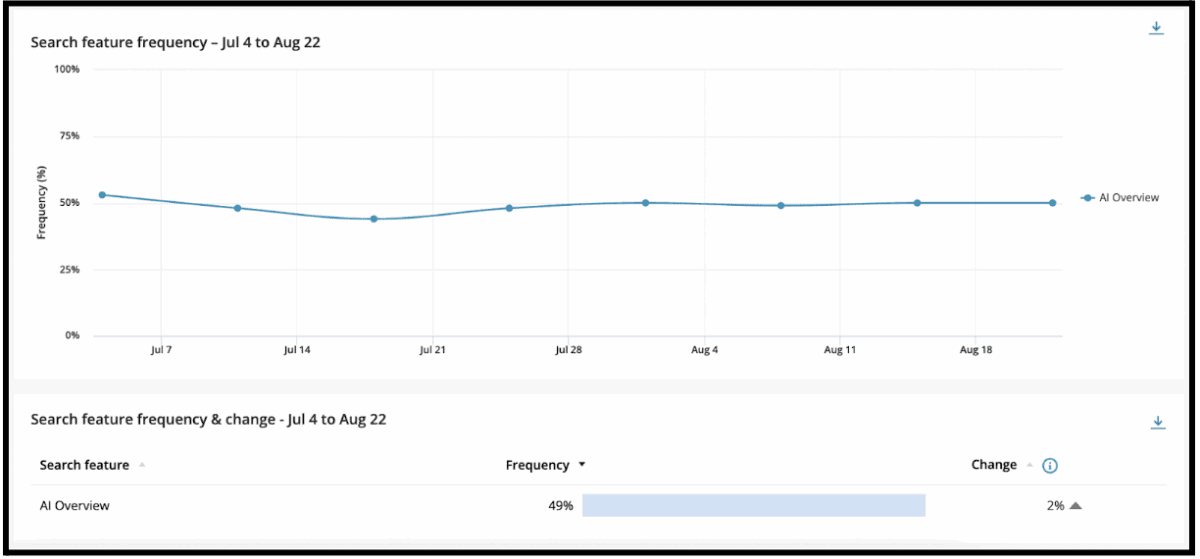

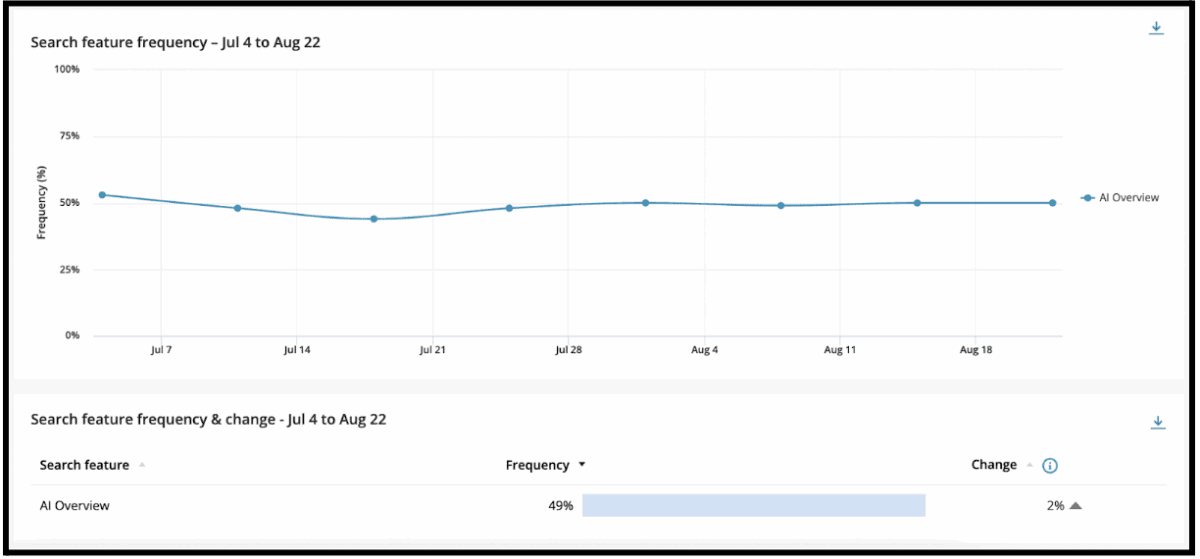

Adthena’s Search Landscape showing AIO frequency changes over the last 7 weeks in the US healthcare market.

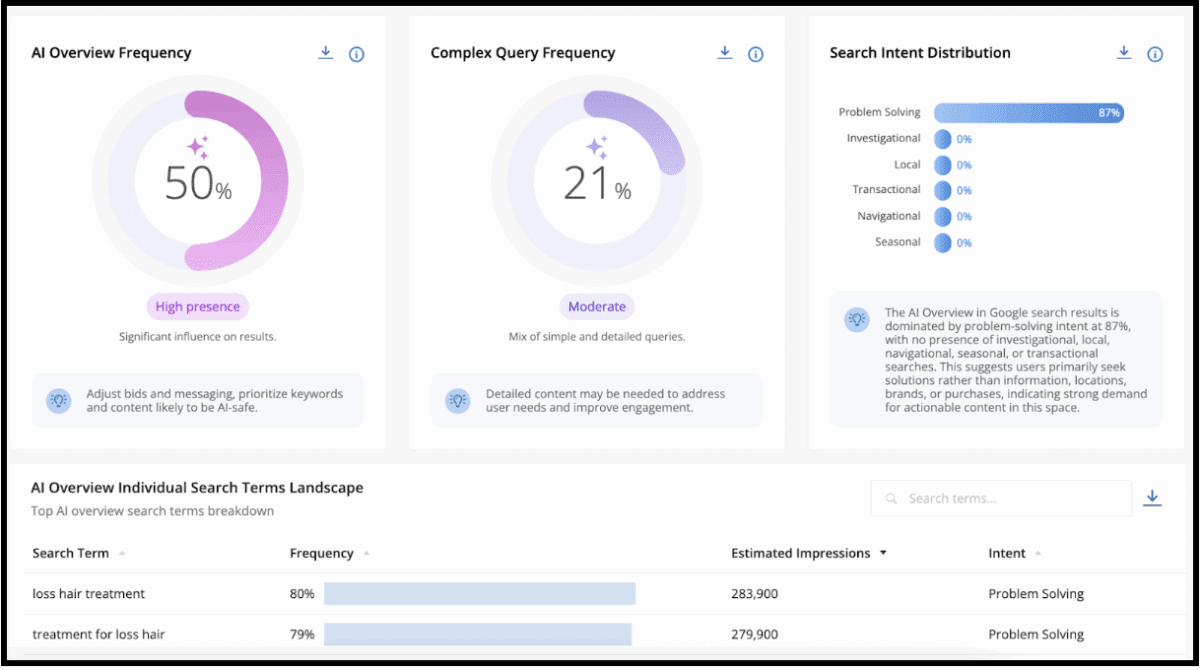

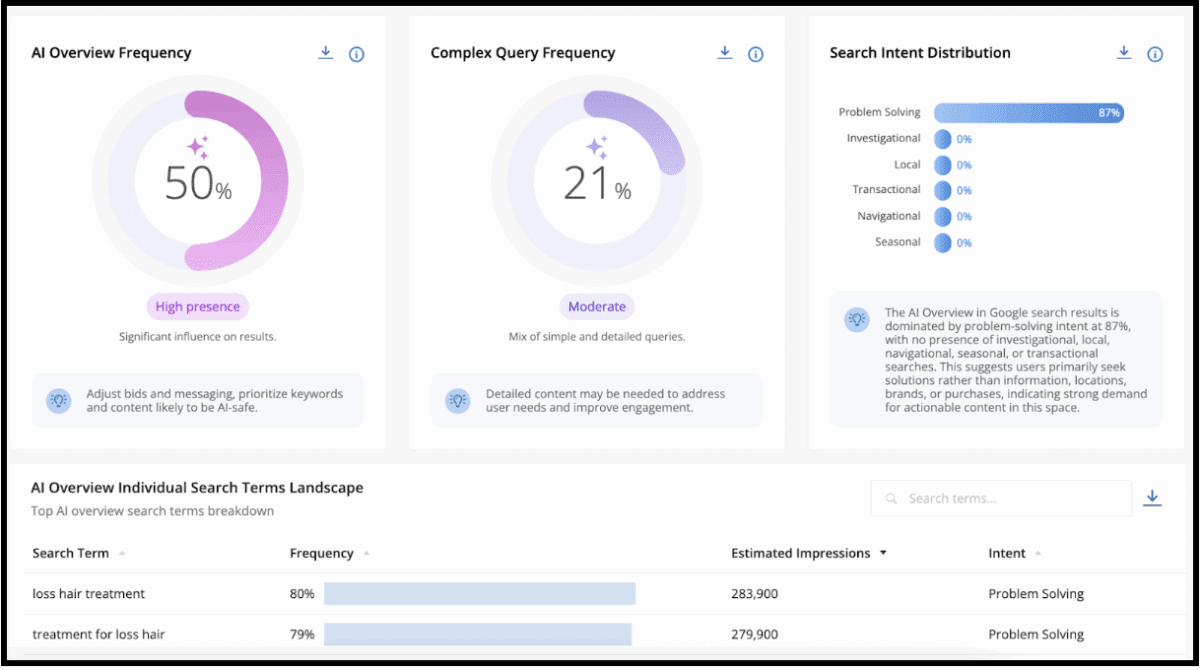

Adthena’s AIO Dashboard reveals AI Overview Frequency, Complex Query Frequency, Search Intent Distribution, and individual search term breakdown for the US healthcare market.

Healthcare stands apart, with AIOs appearing on more than half of all queries for the search term “treatment”, the highest penetration across industries. This makes sense given the nature of user behavior: 87% of healthcare queries are problem solving in intent, and Google has leaned on AIOs to provide quick informational answers.

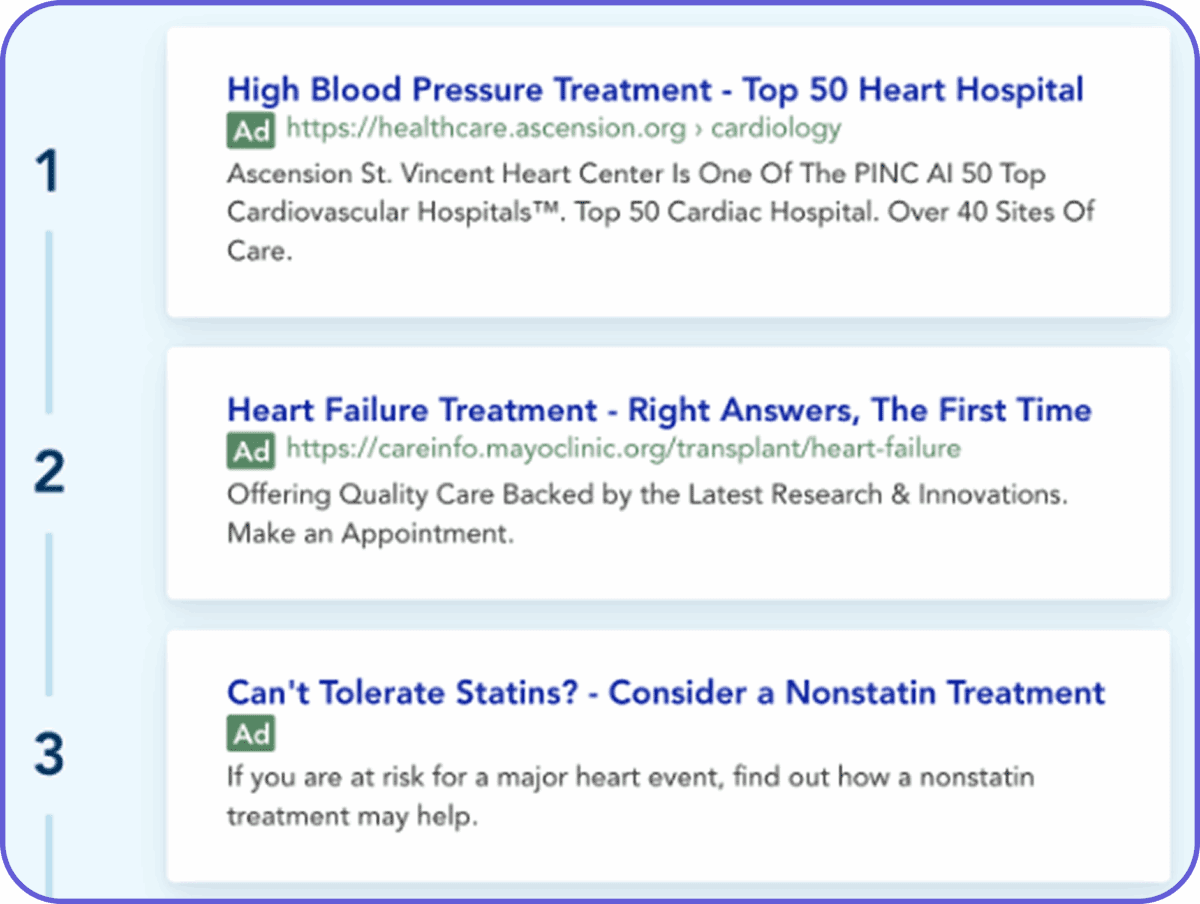

Healthcare advertisers should re-evaluate ad copy based on funnel stage and query type. For high AIO queries, more targeted lower-funnel messaging that emphasizes trusted solutions, professional care, or product options will resonate once the informational need is met. On queries with lower AIO presence, upper and mid-funnel ad copy can continue to capture attention earlier in the journey.

Brands leveraging these AI insights are better positioned to capture incremental clicks, minimize wasted spend, and adapt quickly to changes in patient and HCP search behavior.