With the coronavirus impacting markets across the globe, we take a look at what’s happening to key sectors in Australia, through the lens of competitive intelligence for paid search. What can Google Ads tell us about what’s going on in the groceries, flights and education markets? What do the changes mean for your business and your digital strategy?

The spending spree highs and lows

Some shelves are more empty than others, but we’ve all seen them in the supermarkets when we pop in to buy our essential items for the week. Many consumers have switched to online shopping and deliveries for household items, as we’re all encouraged to distance ourselves from others more and more in many parts of the globe.

As the demand for basic household items takes its toll on supply chains, Amazon is banning sellers from shipping any non-essential items to its warehouses in the USA and the UK.

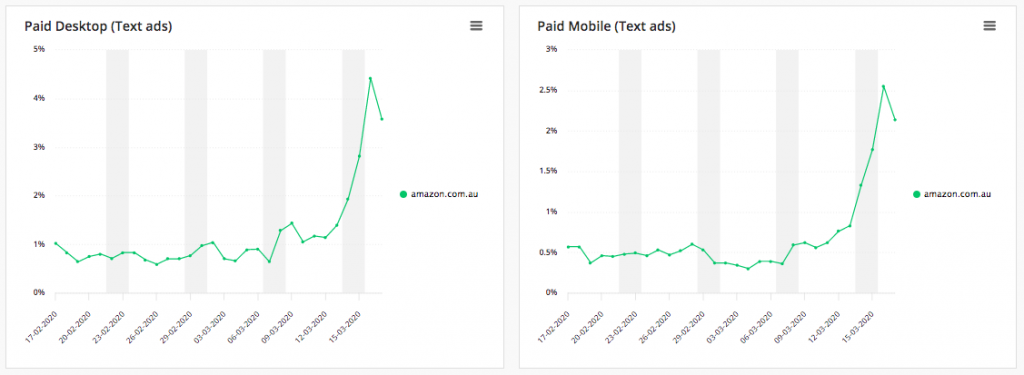

Is Australia responding in the same way as the rest of the world to the shopping crisis? The Adthena paid search platform tells us that the impact in Australia hasn’t hit in the same way yet. We can see in the graph below that over the weekend, Amazon actually increased its paid search spend for essential items such as baby nappies and health products in Australia.

Image: Amazon ramped up paid search ads for essential items over the weekend in Australia.

Which businesses are thriving on home deliveries?

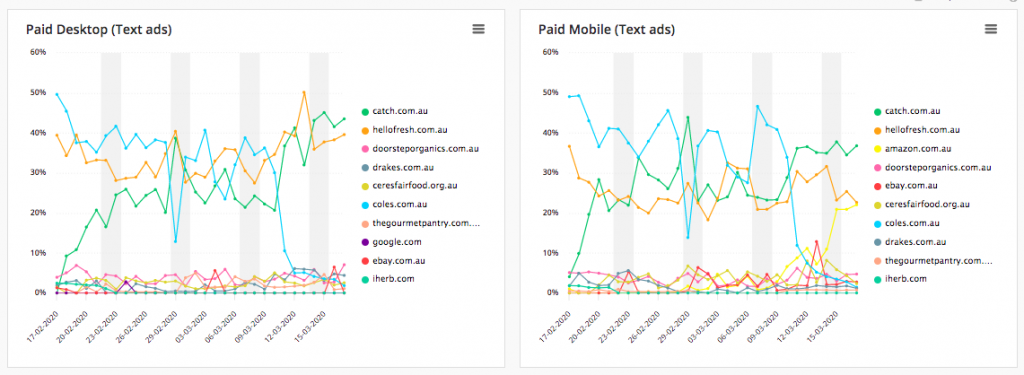

With the high demand and shortage of available delivery slots, plus new shopping restrictions in place, supermarkets such as Coles have stopped bidding on ‘online shopping’ and ‘delivery’ terms altogether. However, we can see in the graph below that digital-first operators Amazon, Catch and HelloFresh have increased their spend in response and are thriving on the increased demand.

Image: ‘Online shopping’ Google Ads spend flips in response to the increased demand

Sky high or nose-diving?

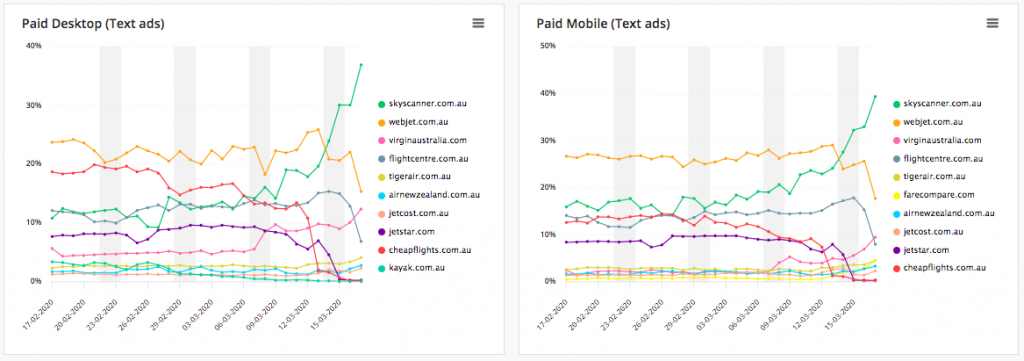

With many airlines reducing flights, and countries around the world closing their borders as the coronavirus pandemic worsens, we can see that many airlines and industry operators such as Cheapflights and Jetstar have stopped running SEM campaigns on generic ‘airline’ and ‘flight’ terms altogether.

However, although aggregator Skyscanner is probably spending the same as they always did, because everyone else is dropping out, their share has skyrocketed as people continue to search and find out which flights are still operating and where.

Image: Skyscanner soars in generic ‘airline’ and ‘flight’ terms

School’s out for the summer?

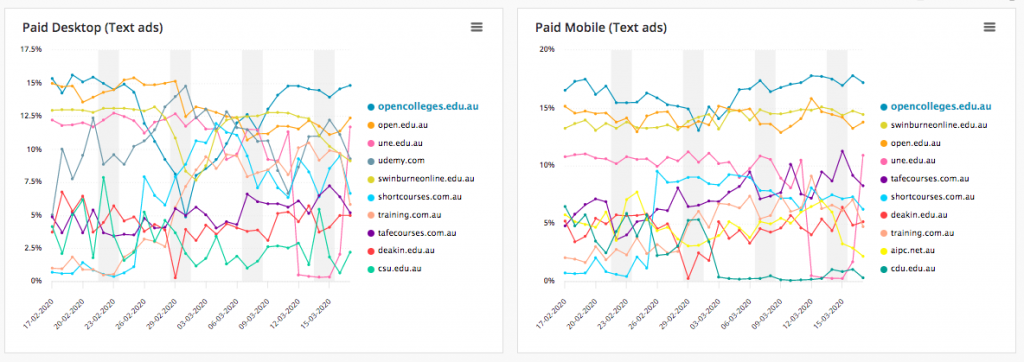

Online educators, Open Colleges, have maintained their share of clicks across ‘online course’ terms over the last month according to the data. They will, however, need to continue monitoring any significant uplift from Universities and other competitors over the coming weeks and months.

Traditional Universities in Australia have understandably been impacted significantly by the coronavirus, with social distancing on the up and closures on the horizon. They are responding by using competitor insights to inform shifts in their digital strategies, particularly across ‘online study’ related keywords.

If the current crisis forces Universities to shift their SEM budget towards ‘online course’ terms this will encroach on online operators’ share of clicks and average CPCs – and they will need to implement defensive tactics. We can also see in the below graph that Shortcourses.com.au have increased their spend significantly in the last 2 weeks on online terms.

Image: The battle is on for online education search terms

Summary

How will your business respond to these market insights in the current state of flux? Competitive intelligence can help you assess the paid search landscape and clearly see what’s going on in the markets at a deeper level. That means you can make strategic decisions to defend your space or take advantage of new opportunities and gaps in the market. If you’d like to find out more about how we can help – get in touch below.

About Adthena

Adthena is the world’s most advanced intelligence platform for paid search advertising. Our AI technology and machine learning models give our customers a clear view of the market shifts and all the moves their rivals make across the search landscape. Which means they can make informed, strategic decisions and ensure success, supported by our team of world-class industry consultants.

If your business has been affected by Coronavirus and you’re uncertain about how to move forward with your search strategy, we’re here to help.